Cross-Region Seed Map #1 Health Insurance

Introduction

We have an InsureTech company in Indonesia called Rey, which is one of our portfolios.

With a unique business model integrating health insurance and medical services, the company offers users the benefits of health insurance along with the advantage of immediate access to medical services. One of the distinctive features of Rey’s product is its platform that integrates health management and medical services, delivering continuous value to users. For instance, users can utilize services such as chatting with doctors, medication delivery, and making outpatient appointments through Rey’s app. Furthermore, there are comprehensive features for maintaining health, including hydration, achieving step goals, and supporting appropriate nutrition intake. By utilizing these services, users can manage their health more easily and effectively.

In addition to the B2C model of directly providing services to users, Rey also offers healthcare services for employees through companies as a distribution channel. Over 70 companies trust Rey as part of their employee benefits.

Incompleteness of Public Insurance

To understand the demand for businesses like Rey, which offer a blend of health insurance and medical services in Indonesia in 2024, it’s important to overview the extent of the penetration of the public healthcare insurance system, known as “universal health insurance” in Japan, achieving nearly 100% enrollment rate, and the enrollment rate of complementary private health insurance services expected to fulfill supplementary roles.

The public healthcare insurance system in Indonesia began a decade ago in 2014 with the establishment of BPJS Kesehatan (the implementing institution for health insurance). This system aims to provide free medical services, in principle, to all citizens and foreign nationals working in Indonesia for more than six months. As of 2022, the enrollment rate is approximately 83%.

Private health insurance functions as a supplement to the public healthcare insurance system, particularly as expectations rise for high-quality medical services not fully covered by the public system. Despite increasing demands, the penetration rate remains low at only 5% (compared to around 80% in Japan).

Rey’s business model is positioned as a corporate welfare solution in this market structure. While the public healthcare insurance system aims to cover all citizens in Indonesia, additional private health insurance is necessary to access high-quality medical services and cater to specific medical needs. In response to this demand, Rey provides a platform integrating insurance and medical services, enhancing its value particularly when utilized by companies for employee benefits.

Regarding market trends, the Indonesian healthcare insurance market is expected to grow at an average annual growth rate of 7.7% until 2027, with further increases expected in the penetration rate of public healthcare insurance. Meanwhile, although the penetration rate of private health insurance remains low, growth is anticipated due to increasing demand for high-quality medical services.

B2C vs B2B2C

Given that the public healthcare insurance system is not fully pervasive and private healthcare insurance is in an undeveloped stage, it’s safe to say that technology will undoubtedly uplift the overall market standards of the country, threading through these gaps. The next point of consideration is whether the improvement in health insurance enrollment rates or the enhancement of medical service experiences will emerge through the B2C model, directly appealing to individual consumers, or through the B2B2C model, focusing on employees working for corporations, and which approach holds greater potential.

Considering the market structure of emerging countries like Indonesia, the B2B2C model appears to be a relatively effective approach. With many domestic industries still growing and employing a significant workforce, offering services through these companies can effectively accelerate the proliferation of health insurance. Additionally, in cultures where companies prioritize employee health, the B2B2C model reduces corporate health management costs and contributes to increased employee productivity, making it an attractive option for decision-making entities within companies.

Moreover, there is a clear correlation between income levels and health consciousness. As income increases, people tend to invest more in their health and quality of life. This is manifested in various forms such as increased access to better medical services, higher spending on health foods, and participation in fitness and wellness activities. The phenomenon of rising health-related markets with increasing average income is observed not only in Indonesia but also in many other countries and regions.

Furthermore, the increase in income is closely related to economic growth, and the continuous growth of emerging companies and their employees can be a key driver in raising the overall income level of the country. Focusing on growth companies requiring a large workforce, the B2B2C model is considered an effective approach for the following reasons:

- Reduction in corporate health management costs: Companies can maintain employee health through health insurance, prevent absenteeism due to illness, and enhance productivity. Providing health insurance as part of employee benefits increases employee satisfaction and contributes to attracting and retaining talent.

- Easier adoption of services: Companies can raise employee health awareness through their own health management programs and health insurance. This helps employees understand the importance of investing in their health and enhances their understanding of the value of health insurance. Having customers understand the value of the solutions provided is ideal for service vendors like Rey as it increases the retention rate of their products.

- Lower customer acquisition costs: Directly appealing to employees of growth companies can effectively communicate the value of health insurance, as there is a tendency for increased health consciousness with rising income levels. With the B2B2C model, reaching out to these employees allows for an effective presentation of the value of health insurance.

However, there are also considerations to be made with the B2B2C model. There is a “kickback culture” in corporate insurance contracts in emerging countries. For example, in the Indonesian corporate insurance sales scene, kickbacks are recognized as a sort of common practice, and there are times when individual transactions may result in negative profits. Human resources personnel, who are the gatekeepers for introducing welfare services, tend to choose insurance companies that offer the highest kickbacks, rather than those that are beneficial for the company or employees. Large insurance companies can secure profits through other distribution channels or cross-selling products, allowing them to afford losses in corporate insurance sales. However, for startups with thin capital and few products, this is not a feasible strategy to emulate. Therefore, to ensure sustainable growth by securing sufficient profit margins, startups must provide intrinsic value through their products, rather than merely lowering prices or offering higher kickbacks.

Business Seeds in India

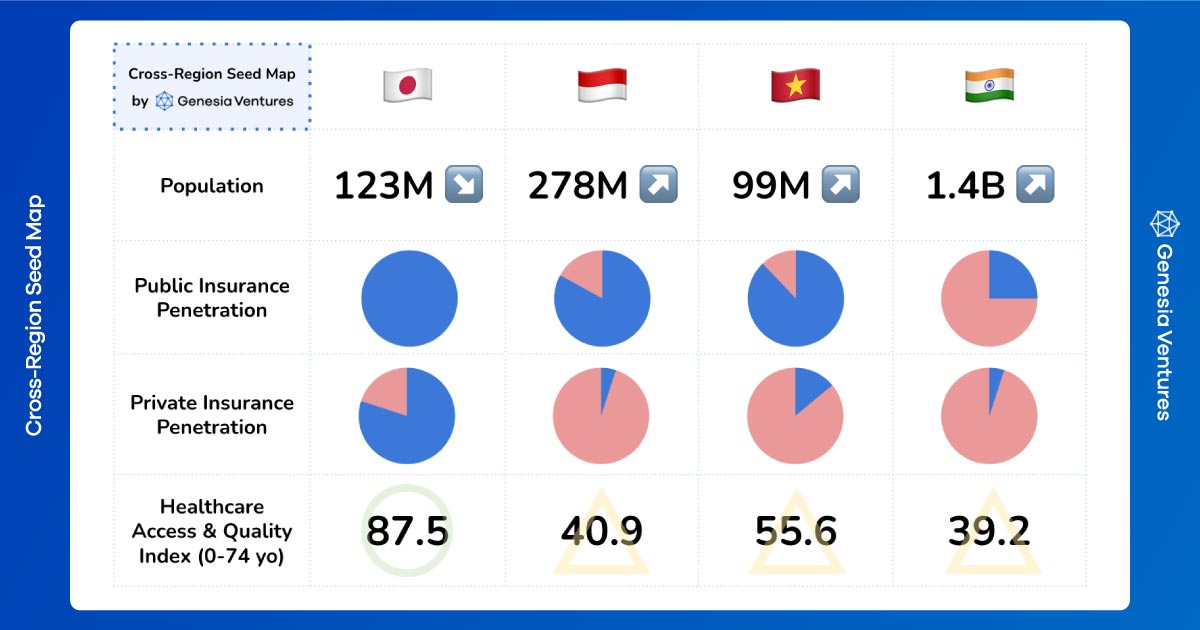

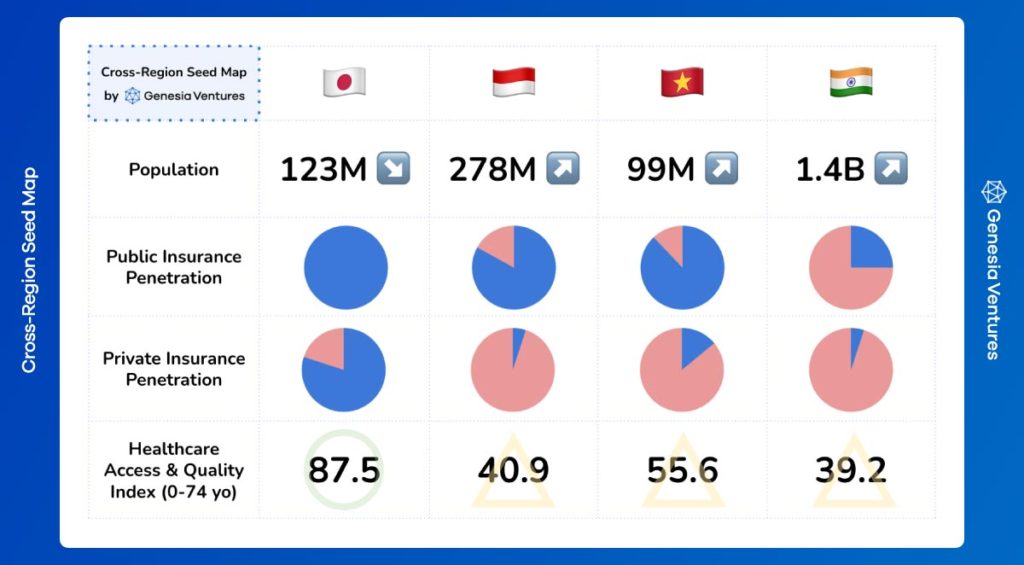

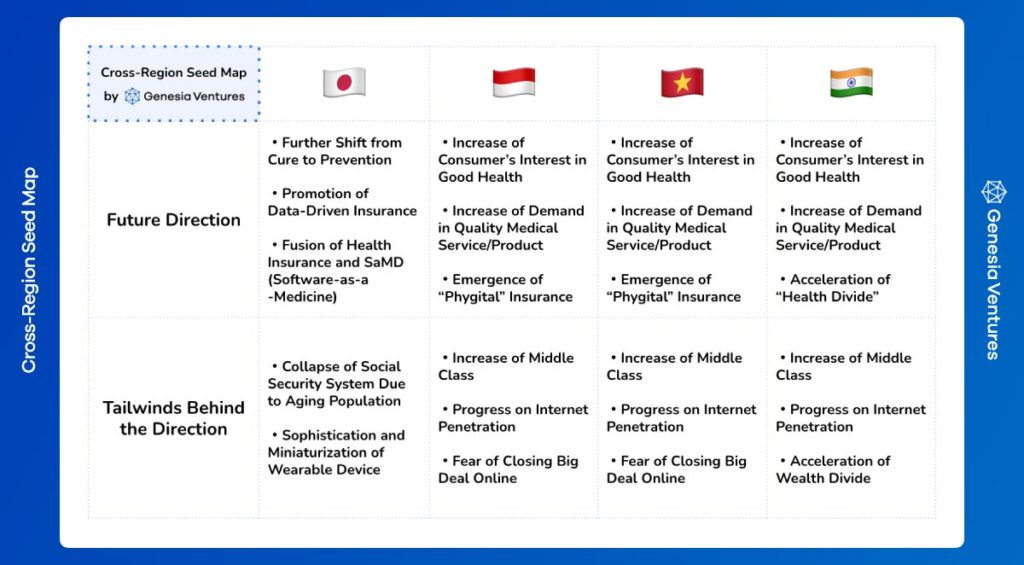

Now we understand the business potential of health insurance + medical services while referring to Rey, an investment opportunity in Indonesia. Can this promising business model be expanded and applied to other countries? The following comparison table lists parallel data on the theme of health insurance in Japan, Indonesia, Vietnam, and India, countries where Genesia Ventures has local investment bases, to explore this possibility further.(References at the end)

From the perspectives of demographics (an upward trend in the population bonus period), the incompleteness of the public healthcare insurance system, the low enrollment rate of private healthcare insurance, and accessibility to medical services, it can be considered that India has a market structure most similar to Indonesia among the four countries.

As a point of difference between the two countries, there is the scope and penetration rate of the public healthcare insurance system. While Indonesia’s public healthcare insurance aims for the so-called universal coverage, targeting essentially the entire population, India’s system is limited to low-income earners, resulting in a penetration rate of only about 25%, approximately one-third compared to Indonesia’s 70%.

From the perspective of Indian entrepreneurs, there are two points to consider regarding these differences. Firstly, the necessity for market enlightenment about health insurance itself. It’s crucial to raise awareness about what health insurance entails and why it’s necessary to generate demand. Secondly, the perceived magnitude of risks associated with compromising health. The fact that individuals outside the low-income bracket are not covered by public insurance means they have to bear the expenses for medical services out of pocket, leading to a significantly higher motivation to maintain health compared to the population under a universal healthcare system.

Personally, I believe the latter point holds greater significance in considering this business compared to the former. In addition to the fact that there’s no point in stimulating demand where there isn’t any, it ensures a structure where users willingly engage in health promotion programs provided by service providers like Rey. In this regard, India’s relatively low penetration rate of public healthcare insurance, compared not only to Japan but also to Indonesia and Vietnam, could potentially serve as a tailwind rather than a disadvantage for startups providing products in this field.

Another point of discussion is the strategic divergence of whether to partner with existing major insurance companies or to challenge the dominance as a digital insurance provider. The Indian insurance market is dominated by the top five major companies, and if opting for the approach of digital insurance providers, it would require advanced resources and knowledge for administrative authorization and risk assessment. Therefore, for startups, deciding which approach to take at the initial stage would be the most crucial strategic decision. Additionally, it’s essential to pay attention to government initiatives to promote insurance coverage and regulatory reforms, as utilizing these as tailwinds is also extremely important.

Case 1 : Plum Insurance

As a case study we can refer to Plum Insurance, a Bengaluru-based startup that provides health insurance solutions for businesses. Plum Insurance focuses on approximately 400 million people in India who have the ability to pay small premiums but lack access to comprehensive products at appropriate prices, known as the “missing middle” 1. This segment has been largely overlooked as traditional insurance products mainly targeted the affluent. Plum has accessed this untapped market and achieved rapid growth by filling this gap.

Utilizing technology, Plum Insurance has innovated the customer experience with features such as a 60-second purchasing experience and WhatsApp-based claims experience 1 2. This has significantly improved transparency and efficiency in the process compared to traditional insurance companies. Additionally, by simplifying insurance purchasing and management through technology, Plum attracts particularly tech-savvy young customers. Plum also offers comprehensive insurance coverage, including areas not covered by traditional insurance products such as LGBTQ, gender reassignment surgery, outpatient treatment for mental illness, and IVF (in vitro fertilization) 1. By catering to diverse needs and providing tailored coverage, Plum distinguishes itself from major insurance companies, attracting a broader customer base including younger demographics.

Another important point is the regulatory support from the Indian government. The government mandates employers to provide health insurance, providing significant growth opportunities for companies like Plum 2.

Case 2 : HealthifyMe

While Plum provides group insurance solutions for corporations, HealthifyMe, another startup also based in Bengaluru, offers products that cater to individual health management needs in a direct-to-consumer (B2C) format.

HealthifyMe’s services are primarily delivered through mobile apps, where individual users can download the app and utilize features such as meal tracking, exercise logging, and calorie tracking. Additionally, HealthifyMe utilizes AI technology to provide personalized health management plans and supports users in achieving their health goals 11. Beyond mere calorie counting or exercise tracking, it offers a platform where users can manage every aspect of health comprehensively, including sleep, blood pressure, and menstrual cycles 12. This holistic approach provides users with a deeper understanding of their health status and concrete means for improvement.

What to Learn and Where to Dig In

Plum Insurance and HealthifyMe each focus on different market segments and have distinct characteristics in terms of customer acquisition difficulty and profitability. Plum Insurance targets corporations, which requires a certain amount of time and effort for customer acquisition, but once acquired, high profitability and stability can be expected. However, as mentioned earlier, if acting as agents for existing insurance companies, there may be a risk of kickback fees affecting profitability, so caution is needed in this regard. On the other hand, HealthifyMe targets individual users, making customer acquisition relatively easy, but with higher variability in revenue and requiring essential efforts for user retention.

Therefore, while promising startups have already emerged in this domain in India, considering the low penetration rate of private health insurance nationwide (below 5%), there is still ample opportunity for entry, including adjacent business areas. Unlike countries like Japan, which have established universal health coverage and have seen a certain level of private health insurance penetration during periods of rapid economic growth, India offers an environment where untapped potential demand for health insurance can be tapped into, and insurance businesses can be launched from scratch. In addition to the digital insurance for corporates and health management solutions for individuals mentioned above, other potential business ideas such as connecting the emerging upper-middle class with advanced healthcare services domestically and internationally through medical tourism could be interesting.

If you are an entrepreneur interested in this domain or already progressing with a business idea, please feel free to reach out! You can contact me directly via LinkedIn DM or through my email address (s@genesiaventures.com), and I will review your message and respond accordingly.

References for Comparison Table

Population:https://www.worldometers.info/population/

Public & Private Insurance Penetreation:https://www.mhlw.go.jp/content/12400000/000377686.pdf・https://healthcare-international.meti.go.jp/files/document/countryreport_indonesia_vf.pdf・https://healthcare-international.meti.go.jp/files/document/countryreport_VietNam_2021.pdf・https://healthcare-international.meti.go.jp/files/document/r4_2023fy/countryreport_india_vf.pdf

Healthcare Access & Quality Index (0-74 y o):https://www.thelancet.com/pdfs/journals/langlo/PIIS2214-109X(22)00429-6.pdf