Genesia Ventures released ESG Report 2023

Genesia Ventures, Inc. (CEO: Soichi Tajima, Head Office: Minato-ku, Tokyo) has published the Genesia Ventures ESG Report 2023 (“ESG Report 2023”).

In this report, we conducted a survey regarding ESG management among Japan-based startups (approximately 90 companies) invested by Genesia Ventures.

Why is Genesia, a Seed VC, focused on ESG?

We believe that by nurturing ESG management philosophies and corporate culture from an early stage, we can help rapidly changing startups strengthen their organizational structure and seamlessly build a governance system. We believe that these efforts translate to favorable evaluation from business partners and investors, and by diversifying sales channels and procurement sources, this will ultimately lead to maximizing corporate value.

In the VC/startup industry, companies in the Seed to early stage(s) in particular tend to focus mainly on business issues, with the trend of incorporating ESG just beginning to gain traction. As social expectations for startup support, including government policy, increase, the importance and presence of VC as an asset class in the capital market is also increasing. Looking ahead, akin to listed markets and buyout funds, we anticipate that institutional investors will place even stronger demands on VCs to address ESG issues. In anticipation of such changes, we aim to build expertise in ESG management support for those who are starting up.

This initial report focuses on recognizing and visualizing the facts of how each company deals with ESG and considers it as a part of value creation. We aim to gather more evidence and refine our understanding of whether the initiatives of the startups we support are contributing to improving corporate value. Moving forward, we will establish ESG management methodologies and support systems as a VC that will lead to long-term returns, and create a system that earns the trust of various stakeholders.

Summary of the ESG report 2023

Environment

Environmental Initiatives

For startups in the early stages with company structures that are still developing, most have yet to formulate, measure, and verify specific strategies. In recent years, corporate environmental awareness has begun to change significantly due to the pandemic-induced shift to remote work and the global movement towards decarbonization. Many companies are taking environmentally conscious initiatives based on what they can do in their daily routines (e.g., going paperless, saving electricity, eliminating plastic bottles due to remote work). As companies reach Series A and beyond, such environmental awareness becomes entrenched in their organizational culture, prompting companies to consider specific actions.

Social

Creating Growth Opportunity

Newly established startups, particularly those in the Seed to Pre-Series A stages, typically operate with a small workforce, often comprising fewer than 10 employees. In such small-scale operations, the individual contributions of employees can have a significant impact on the business, which underscores the importance of employee engagement initiatives. Survey results suggest that the majority of these companies empower their staff by delegating authority and offering a level of discretion that allows employees to fully utilize their abilities and talents. After reaching Product-Market Fit (PMF) and shifting focus towards organizational development, many of these startups begin to implement tailored measures that reflect individual strengths and the company’s culture. This often includes the introduction of specialized evaluation and compensation systems.

Promoting DE&I

Diversity and inclusion are essential in organizations because they foster a culture where opportunities are created independent of employment status or personal attributes, aiming to enhance corporate value through the utilization of diverse capabilities. For startups, particularly from Seed to Pre-Series A stages, fostering innovation through the collaboration of team members with varied backgrounds and traits is crucial for improving overall organizational performance and increasing corporate value. This includes placing a high value on cultural fit within the organization.

At the nascent stages of Seed to Pre-Series A startups, the hiring focus is on individual skills and alignment with the company culture. However, as the company evolves, there is a broader embrace of diversity. The concept of diversity can vary depending on the business context, but it extends beyond superficial attributes like age, gender, and nationality to encompass a range of values, skills, and experiences, with the ultimate question being whether an individual can strengthen the organization.

Yet, in practice, challenges persist, such as a limited recruitment pool to source diverse talent, and difficulties in attracting female leaders and youthful innovators to the industry.

Initiatives for Human Capital Management

In the post-pandemic world, as diverse working styles become increasingly commonplace, a growing number of startups are prioritizing discussions around human capital, which is at the heart of a company’s competitive edge. When exploring this subject, various factors come into play, particularly for startups with grand missions and visions that involve managing a multitude of tasks. Critical considerations include whether employees are achieving a healthy work-life balance both physically and mentally, and whether they have access to support channels for consultation.

Survey results indicate that companies at the Series A stage and beyond are relatively advanced in adopting these initiatives. Several firms have introduced pulse surveys to gauge employee satisfaction with their work arrangements and overall well-being. Additionally, some healthcare startups are leveraging their products to monitor and manage employee health.

Governance

Initiatives to build a sound management system

Newly established startups often feature a governance structure where roles of management and execution are closely intertwined, requiring leaders to evaluate and make decisions about their own operational actions. In this context, it is critical to aim for prudent management resource allocation and to maintain ongoing dialogue with shareholders and other stakeholders.

Ensuring the soundness of the management system can be approached in various ways, but a key strategy involves implementing safeguards against internal fraud and embezzlement. Establishing robust corporate structures and internal controls can not only help prevent such malfeasance but also ensure that, should any incidents occur, the company is prepared to take decisive action and be accountable to its stakeholders.

Few Seed to Pre-Series A companies have systems in place to ensure smooth business operations. The initial step for these startups often involves creating operational manuals and managing financial transactions in collaboration with external tax accountants and fintech services to ensure transparency without overextending resources. As companies progress to the Series A stage and beyond, they typically become more aware of the need to establish formal approval processes and double-checking mechanisms, as well as to develop internal audit systems in preparation for a potential future listing.

Build a solid structure by appointing outside directors

Integrating outside directors is a strategic approach to establishing a robust management system. The appointment of outside directors is vital for ensuring that management’s actions are in line with the company’s profitability. Their counsel becomes particularly critical as the company grows, necessitating a clearer distinction between management and execution roles.

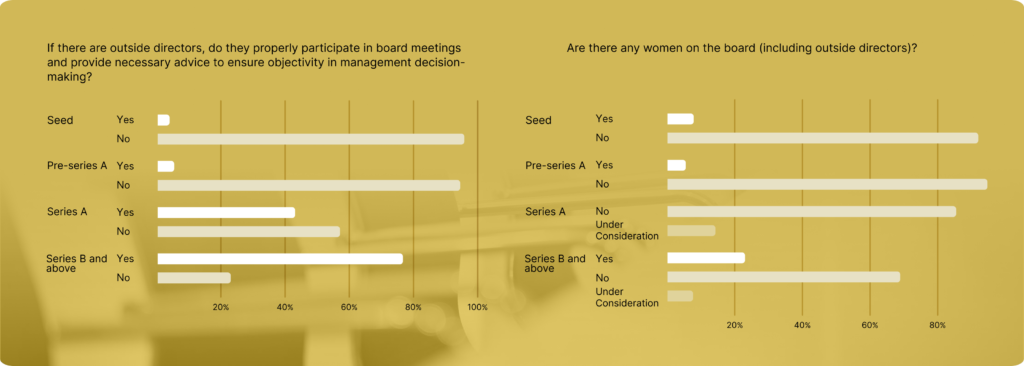

During the Seed to Pre-Series A stages, it is common for companies not to engage outside directors or to lack access to the necessary advisory services. However, as companies evolve beyond these stages, the appointment of outside directors becomes more prevalent, contributing to more effective board operations. Often, outside directors are not limited to providing guidance on management and business during board meetings; they also frequently serve as mentors to the management team.

Moreover, the presence of female directors, including outside directors, is infrequent at any stage of company growth. As highlighted in the DE&I section, appointments are made with consideration for a wide range of values and skills beyond gender attributes. Nevertheless, the scarcity of female directors is predominantly attributed to the limited pool of diverse candidates, including women at the director level.

Pillars of ESG

Based on the above survey results, we believe that it is increasingly important and necessary for startups to be aware of ESG management from an early stage, and hence carry out the following concrete support measures, information dissemination, and event activities. Through initiatives like this, we will continue to support startups in their ESG management and fostering ESG knowledge.

ESG Solutions

We formulated an ESG investment policy in February 2022. As part of our engagement activities based on this policy, we provide support to startups we invest in with a variety of services and hold study sessions for free or at a low price, in order to support the ESG management in their early stages.

Examples

・Establish mental health/harassment consultation desk

・Establish external contact point for public interest whistleblowing system

・Form SNS guidelines

・Hold harassment prevention study sessions

Adopting ESG when considering investment

Based on our ESG investment policy, Genesia Ventures has developed its own ESG checklist to comprehensively understand ESG factors when considering investments. In addition, we identify the “ESG material issues” of our partners, write them in the investment consideration documents, and report them to their LP, who is also their fund investor.

Example

・Develop ESG checklist when considering investment

・Establish rules for describing ESG material issues in investment consideration documents

ESG for Startups

At Genesia Ventures, we deliver information on ESG themes led by Chief Sustainability Officer Kawai. We discuss these topics based on new trends such as “alternative proteins,” `”decarbonization,” “biodiversity,” and “ESG management,” and provide knowledge that will help them realize ESG management.

ESG Summit 2022

In November 2022, we held an offline event “ESG Summit 2022 ~ New trends in ESG through innovation ~” with over 200 people including our LPs, startups, operating companies, financial institutions, government, and the media. Panel discussions were held on themes such as biodiversity, ESG management in ventures, and circular economy ecosystems, which were also effective for networking among participants.

Organizational engagement support measures, G-Owl

As one of our management support measures for startups, we jointly developed a team assessment platform called “G-Owl” with CoachEd Inc., a company that operates a coaching business, and provides it to our partners. We collect and visualize feedback for the management team and organization using a questionnaire method. We then conduct coaching-style feedback sessions with Genesia’s investment managers to help understand the current status and make updates to the management team and organization.

About the report

Title: Genesia Ventures ESG Report 2023

Survey Period: April to May 2023

Survey target: Japanese-based startups in which Genesia Ventures, Inc. has invested

Number of Valid Responses: 91 companies

When quoting or referencing this report, please ensure that the source and a link to the report are clearly indicated (Created by Genesia Ventures, Inc. “ESG Report 2023”, URL: https://www.genesiaventures.com/genesia-ventures-esg-report-2023).

The English version report of this page has been created with excerpts from the Japanese version. If you wish to obtain all parts of the Japanese version, please download it from this page.