The Models of DX

What is “DX”?

In recent years, startups promoting digital transformation(DX) across various industries are redefining Japan’s sectors and building out new digitally-based industrial infrastructure in Southeast Asia. The growing presence of these startups is undeniable.

We believe that this irreversible trend — the digital transformation of industry — is not just about efficiency, but represents a sustainable new structure for various sectors. To do so, we believe that it is necessary to meet at least two factors:

・Implementing a business structure which maintains a balance between the value provided by stakeholders and the benefits obtained therefrom in each industry (e.g. rethinking intermediary players who offer no value in the supply chain, removing stakeholders gaining excess profit to the exclusion of others, and creating business models to redress exploitation of resources).

・Offering products and services not purely focusing on their functionality, but also taking into account UX, thus designing them with a holistic approach. In addition, realtime data on commercial distribution should be readily accessible, to be used to optimize business processes along with the PDCA method.

Our vision — achieving a society that provides wealth and opportunities for all — is not centered on creating technology that broadens the digital divide, but rather solutions that offer benefits to all of mankind. By supporting startups developing these products and services, we believe we can create a more sustainable and rich society, and that such a society will be achieved precisely through demonstrable DX.

The Models of DX

Over the course of finding and supporting promising business models that are aligned with these ubiquitous trends and changes worldwide, we came across different types of DX and have built up a wealth of data on them.

When reviewing new investment opportunities, we analyze the business in terms of how it fits into one of these categories, and use it to make value-added proposals. Developing a body of knowledge on these different types of DX enables us to find new investment opportunities. We engage not only with cases in Japan, where DX is chiefly being used to revitalize existing industries, but also new trends in Southeast Asia, where numerous ventures are innovating and leapfrogging incumbent players and existing solutions.

Whenever we discover a new DX model, we take note and add it to our knowledge base, and in this article we will cover some of those cases. We hope that it serves as a useful compass for entrepreneurs in the DX domain, for those developing new business models within large enterprises, and for investors interested in DX-driven startups, enabling us all to align our trajectories towards a better tomorrow.

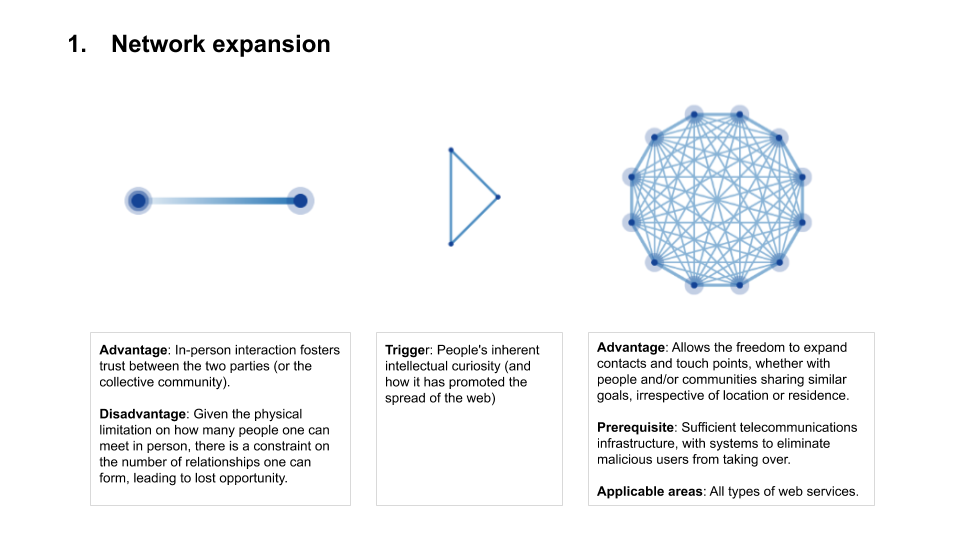

The most basic type of framework is network expansion. Prior to the emergence of the Internet (the World Wide Web), the exchange of information and transactions were only performed within specific schools, companies, groups, and organizations in the real world. As the Internet (and subsequently the applications that were built on top of it) became more widespread, people are able to enjoy various advantages and are free from geographical limitations. They can overcome constraints of time and space to access information and be a party to deals and opportunities.

This is the most basic and ubiquitous type of DX, and applies to nearly all web services. Specific examples include Instagram and Twitter (social media), which expand person-to-person networks, and Amazon, Rakuten and the App Store (marketplace), which offer commerce networks.

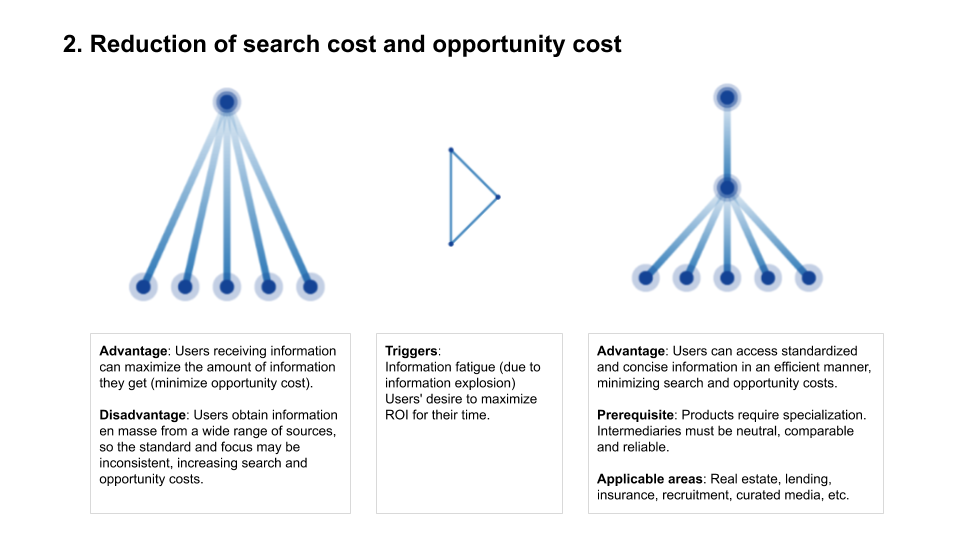

The second type is the reduction of search cost and opportunity cost. This model is in a sense the opposite of the first type: now that more information can be accessed without restrictions through the Internet, it has led to significant costs associated with efficiently organizing that information in a meaningful format to aid the decision-making process. This in turn triggers the emergence of new intermediary players who aggregate and organize complex information and deliver it to users in the format they desire.

Examples include vertical media like TripAdvisor (travel), Yelp (dining), and Zillow (real estate), as well as curated media like SmartNews and Gunosy. One of our partners is Mobilkamu, an intermediary platform for sales of new vehicles in Indonesia. Their solution is emblematic of those reducing search and opportunity costs in the new vehicle purchase process, and has enabled them to post excellent performance.

Given that the more specialized the information needed for decision-making is, the higher the search and opportunity costs, intermediary services offering demonstrable neutrality, reliability, and with a value that could be easily compared to other providers offer major benefits to end-users. For products like life insurance and real estate, which are comparatively expensive and pose hurdles to the users’ decision-making process, the UX will customarily consist of both online and offline interaction to reduce the cost of decision-making. A Key Success Factor (KSF) here is being able to create a hybrid model in which technology is intermeshed with existing offline operations.

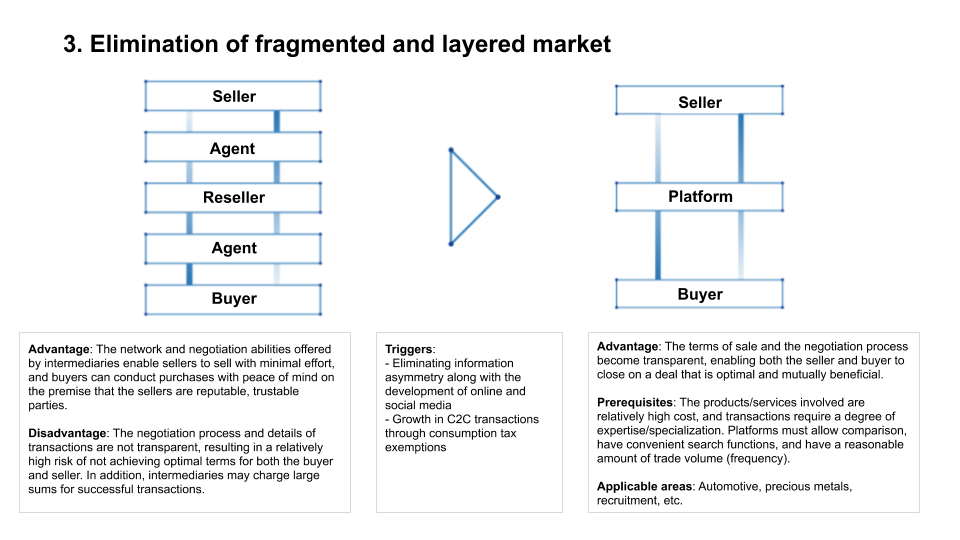

The third type is the elimination of fragmented and layered markets. For industries in which the cost of goods or services are high due to the level of expertise required (such as real estate, construction, and recruitment), multiple layers of intermediaries between users and providers is the norm today.

However, as more information moves online and the information asymmetry between the user and the provider is eliminated, intermediaries who bring little value to the table will be increasingly pushed out, and stakeholders who previously benefited above average gains will see their gains become more spread out, initiating an irreversible shift towards industries where services are provided at fair market rates.

The above figure illustrates how transparency in secondary real estate market transactions would work (Non Brokers, one of our portfolio companies, is promoting this shift towards residential inspections as a more rationalized solution). Other players streamlining formerly stratified industries are Shelfy (construction sector), Raksul (printing sector), and Bizreach (human resources).

However, this does not imply that all intermediate players in each industry will be immediately eliminated. Those players seen as offering value through their intermediation, such as garnering trust and bringing bargaining power to the table underscored by a prior track record, and making appropriate judgments, will likely outlast such a culling and continue to thrive. This is precisely the reason SaaS businesses targeting mid-tier players are on the rise. As SaaS streamline business processes, and internal operations and transactions are digitized as data, this will visualize the value provided by each player and the value offered through intermediation. In turn, this will trigger a shift in business transactions to a sustainable format. This aligns well with our vision, so it is an area of particular focus for us.

Since C2C transactions do not carry additional consumption tax, this is a major trigger in the medium to long term, and high-priced products such as second-hand property, used cars, and precious metals, which are traditionally bought and sold through organizations, can increasingly be traded directly between consumers through reliable intermediary platforms.

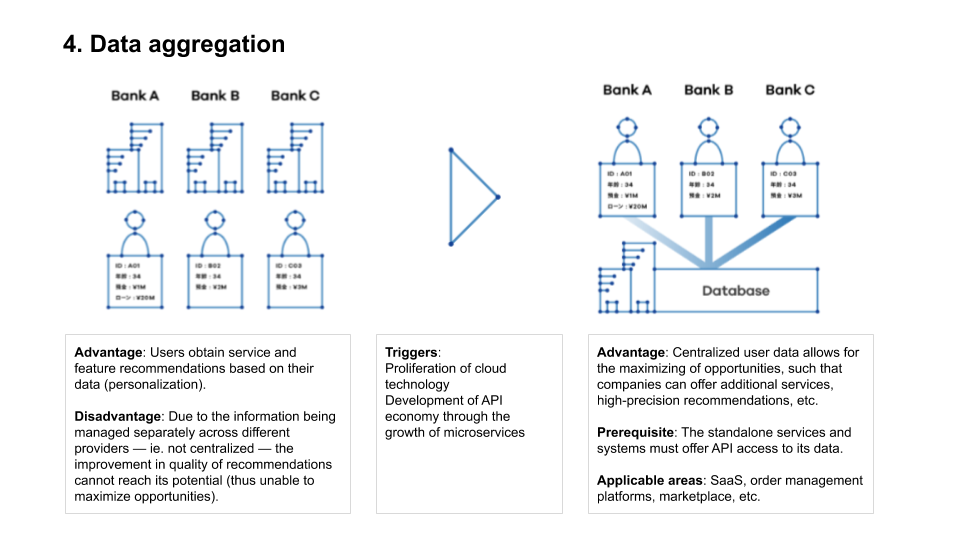

The fourth type is data aggregation. Unlike the previous three, this type does not represent an irreversible shift from left to right (refer to the above image), but rather a repositioning of emerging players relative to existing players. The change in the management of data from a corporate-centric to a user-centric one and aggregating user data as a basis for added value can be considered an example of DX.

The figure above uses individual asset management as an example to illustrate the positioning of companies like Money Forward and Freee relative to major financial institutions such as banks and brokerage firms. Given that more and more systems and applications will be designed around integration with external services moving forward, organizations will most likely store their data with a user-centric approach, and irrespective of industry or category, use the integrated data to make more optimal recommendations to the end-user.

Data aggregation also applies to SaaS (Software as a Service) solutions. As mentioned in the Type 3 (Elimination of fragmented and layered market) above, the essence of SaaS is not operational efficiency, but rather the digitization of data pertaining to internal corporate operations and transactions. In that sense, the services above are typical examples of data aggregation as they use data to improve user experience and offer financial services.

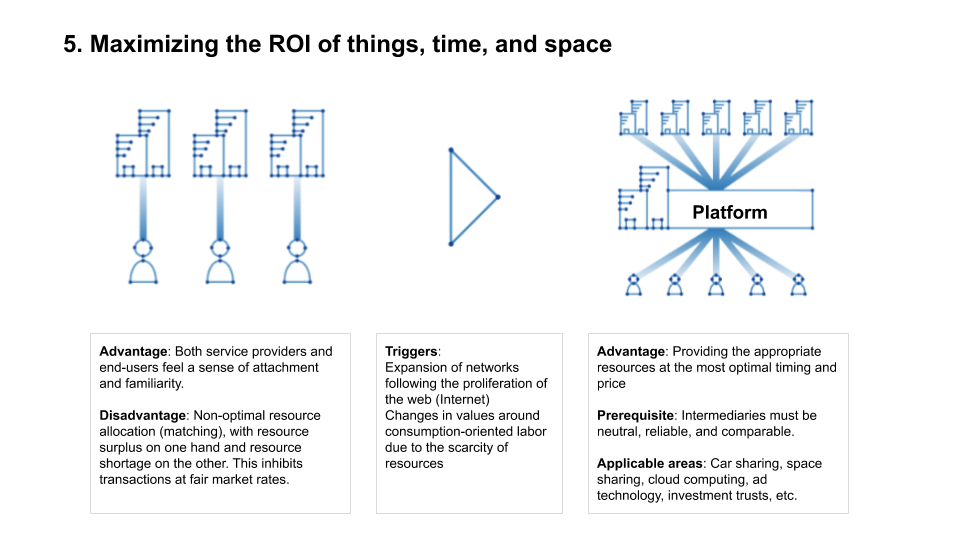

Fifth is the maximization of ROI on things, time, and space. As people and things become more connected, the consumption and labor models will markedly shift from ownership to usage-based, and from occupancy to sharing. This will trigger a shift in values where people seek to maximize the convenience obtained from things, time, and space.

With growing global awareness of SDG (Sustainable Development Goals) and CSV (Creating Shared Value), we move from an age of consumption to an era of circular economy. This will likely lead to a greater desire to maximize the efficient use of things, time, and space, as well as to revamp the trajectory in which resources move through the economic phases of production, consumption, and disposal.

The figure above illustrates the transition from a traditional labor model, in which a worker is hired exclusively by one company, to a gig economy model, where labor resources are provided on a one-off basis. Typical examples include Uber, Grab, and Gojek, which match drivers and users on demand. Among the ventures we support are Sukedachi, which matches construction sites with construction workers, and Timee, an ad-hoc part-time job app. They are developing services that incorporate this type of model and are achieving rapid growth.

In addition to work-sharing, there are services like Airbnb, the home rental service; Spacemarket, which provides space sharing; and AWS and Microsoft Azure for cloud computing, which could be described as solutions that maximize the ROI of things, time, and space.

Conclusion

This article has discussed a variety of examples of DX that we tend to use as conceptual frameworks. As mentioned in the beginning, in order to achieve true DX, companies cannot simply pursue efficiency and optimizations individually and separately from each other. Startups, large enterprises, VCs, government agencies, and society as a whole will have to proceed in tandem towards a common goal.

It is our hope that in order to revamp industries with the power of digitization and realize a sustainable and prosperous society, more and more people come to recognize the ubiquitous changes occurring in the world and make an effort to promote and support these developments.