The Reality of Raising Series A Rounds for Seed Startups

Genesia Ventures had invested in about 80 seed-stage startups in Japan and Southeast Asia since its founding in August 2016. Most of these companies are past the seed stage, and are steadily moving forward with their businesses toward series A and beyond.

To name a few of these companies, there are HRBrain, Sukedachi, BizteX, Baseconnect, and Timee which are based in Japan, and Docquity, Luxstay, Qoala, Bobobox and Manabie based out of Southeast Asia, and as we look back at the growth of these companies, we can find some common and reproducible factors that helped them progress toward their fundraising for series A and beyond.

At Genesia Ventures, we are continuously improving upon our knowledge to help portfolio companies, and in this article, I would like to share some of our observations on the above-mentioned factors, especially with founders who are running companies in the seed-stage that are planning to raise their Series A rounds.

1. Choosing a promising business domain

A “promising business domain” might sound ambiguous to some, so what does it really mean from an investor’s perspective?

Market size is often considered as one of the measures to judge whether a business is promising; in actuality, the approach is more multifaceted. While the points investors look out for will differ depending on the business domain and stage, the factors taken into consideration (apart from market size) include the following:

- whether the business is in line with major trends in the global market;

- the intensity of competition (including replacement competitors) in the business domain; and

- the extent of the demand for that service or product in the global market.

In short, investors evaluate the viability of companies by looking at the market size, direction of business trends, market concentration and competition that could affect the road to achieving the companies’ objectives, and demand size.

In the case where the company is operating in an industry (from the investor’s perspective) that is not in line with the global trends, is rife with competition and substitutes, and has low global demand, the business will not look promising even if the market size is huge. On the other hand, even if the company is operating in a relatively smaller market, but is in line with the trends, has few competitors and substitutes, and high demand in the global market, investors will see the company in a positive light and as a viable investment.

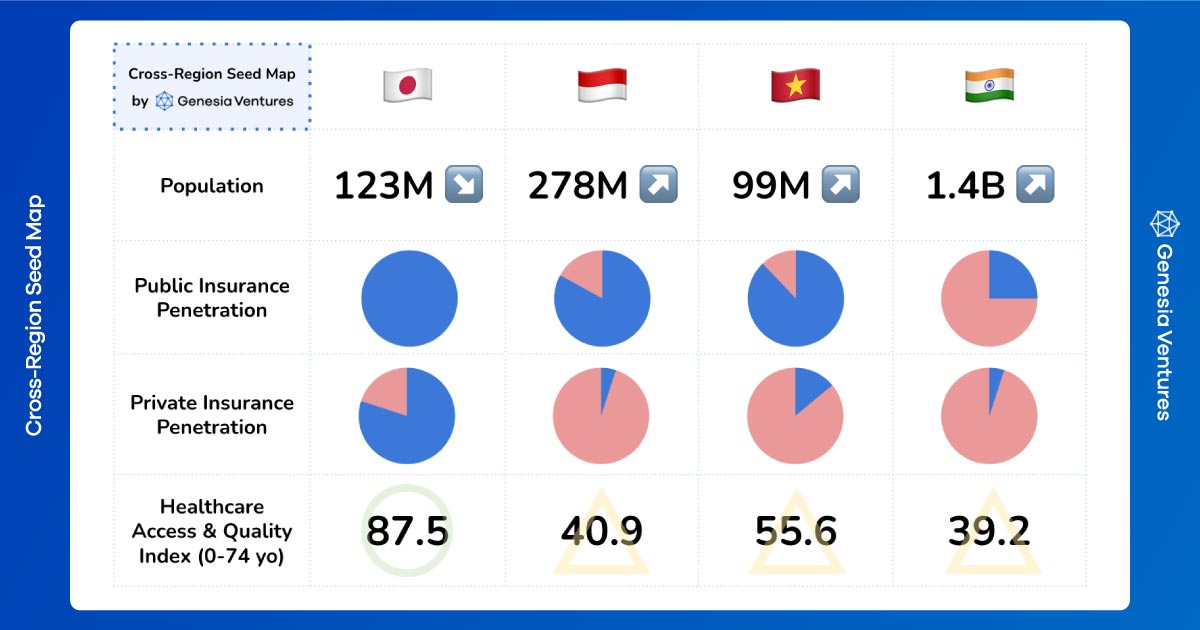

At Genesia Ventures, we focus on investing in the DX (Digital Transformation) of traditional industries, and the OMO (Online-Merge-Offline) model (based on the previously-mentioned concept of DX in the B2C segment), in both Japan and Southeast Asia, because

- there is a large market size,

- it is in line with the global trend in terms of the strong need for DX,

- and although alternative players exist, there are relatively few strong competitors.

Many of our portfolios are operating in business domains that have the above-mentioned factors in common, and the ones that also have strong management teams (which I will discuss next) are very likely to grow successfully and move toward the Series A stage and beyond.

2. Strong management team

Founders often have specific hypotheses they believe in when starting businesses, such as:

- There are big problems to be solved in ●● industry.

- This industry will be evolve into XX in the future.

I’ve found that keeping the following formula in mind comes in useful:

F(x): Business hypothesis ⇒ Y: Reality (actual business status)

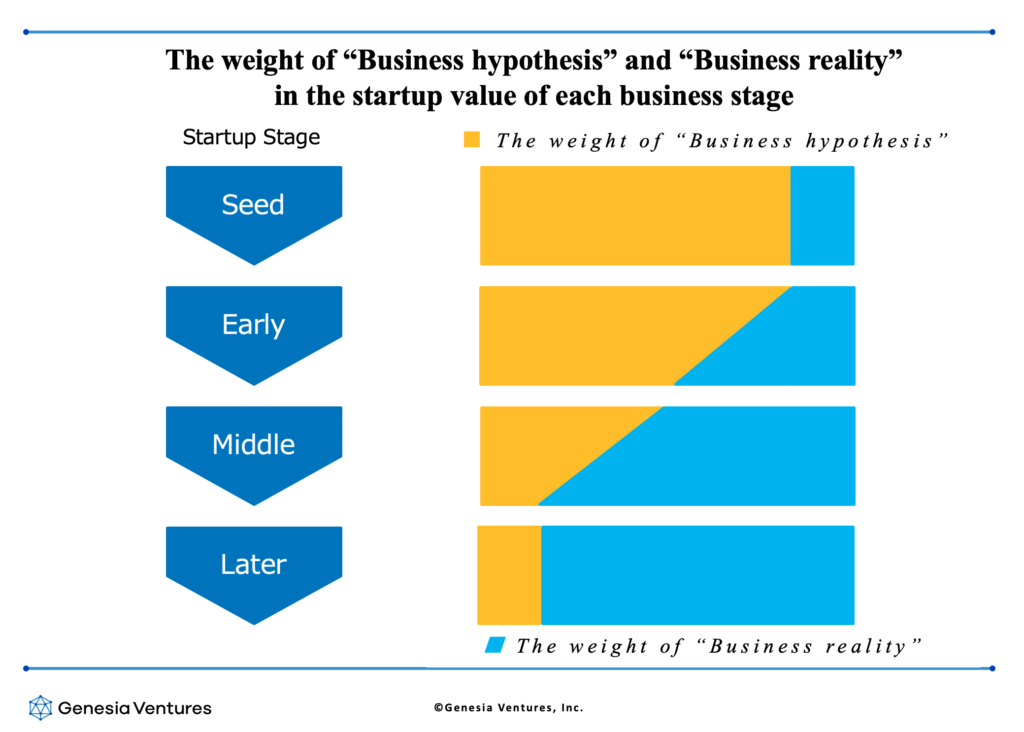

On the left is the management team’s hypotheses on the business, and as the business grows and stage progresses, it should gradually get closer to the right, which indicates the actual status of the business.

The figure below shows that at the seed stage, corporate value consists mostly of the business hypothesis, and as the company approaches the later stage, the weight of the business hypothesis gradually decreases while the weight of the company’s actual business status increases.

What I’m referring to as a strong management team in this case is the team’s ability to transform the business to shift from the left (hypothesis) toward the right (actual business status), and that depends on 2 main factors:

- the level of detail (resolution) of the hypothesis on business strategy; and

- a comprehensive execution ability.

In short, the business depends completely on the competence of the management team.

If investors believe that a team has strong ability to transform their business and move from a business based on hypothesis toward turning that hypothesis into reality, then even with just the hypothesis and little traction to show, the company will be able to raise funding relatively smoothly. On the other hand, if (from the investors’ perspective) the team does not display that strong ability, then even with great traction, investors tend to spend more time looking into the details and negotiating on the valuation.

How investors identify the ability to come up with detailed hypothesis (high resolution) and to execute is usually based on the management team’s career and track record, and the character of the individuals in the team. Other important factors include:

- The structure of the pitch deck, the story, and mid-to-long term strategy;

- Level of detail of the business plan;

- The quality and speed of the discussion and exchanges with the potential investors;

- Effective backcasting based on the fundraising deadline.

3. Ability to Demonstrate Multi-layered Assets

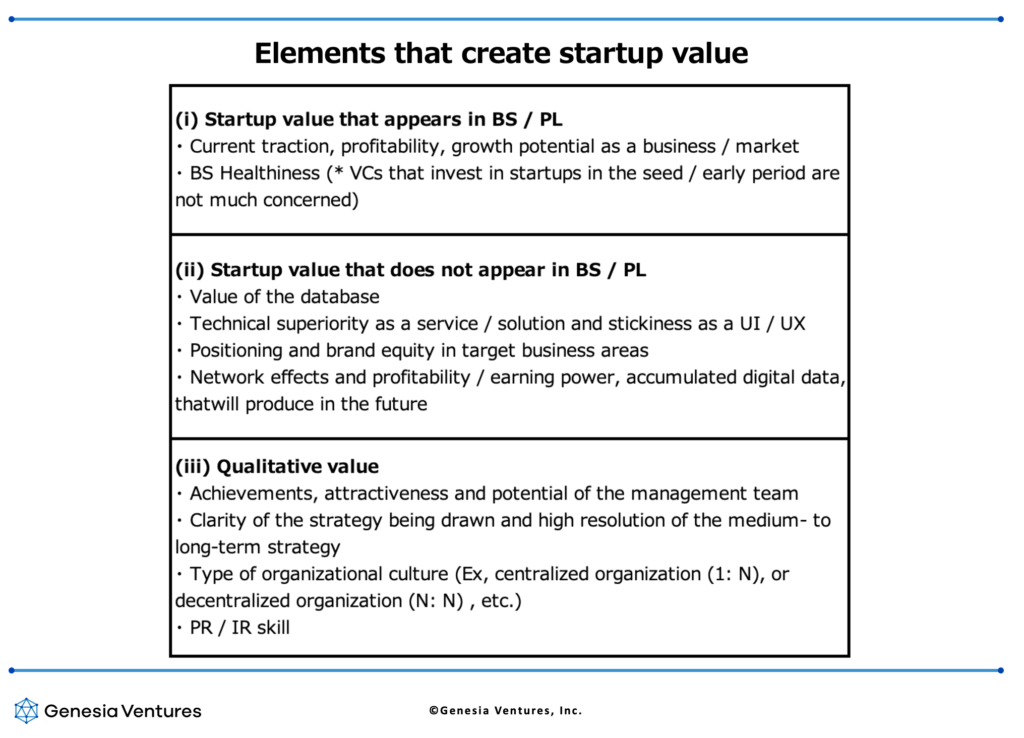

The last topic I would like to cover is on the value of startups (valuation). At Genesia Ventures, the components of the valuation are roughly broken down as follows:

Generally speaking, when it comes to the startup value (valuation), the points in (i) are the main discussion topics. For example, in the case of SaaS businesses, the valuation is often calculated using the formula of 5 to 10 times the company’s ARR (Annual Recurring Revenue). However in reality, there are often cases where the valuation exceeds 10 times the ARR, and investors take into account (ii) the value beyond the BS / PL, and (iii) qualitative value.

As for (ii), investors can often gather information from the pitch deck and from discussions with the management team during meetings, on topics that include the mid-to-long term strategy of the company, the ability to build a sustainable competitive edge (MOAT, clearly explained in a note by Hara-san from DCM, in Japanese), and the level of detail of the plan (again, high resolution). For points mentioned in (iii), besides looking at the management team’s career, track record, and Founders-Market Fit, other important factors to consider are the team’s ability to communicate, influence, and share information with others in their surrounding, the ability to build a strong team, and the ability to build a strong organizational culture.

I strongly recommend that founders look through the above points, and as much as possible, demonstrate each of the “multi-layered assets” of the company.

4. Finally…

While I’ve broken down the Series A fundraising mechanism for seed startups into three points (business domain, management team, startup value) above, it is important to keep in mind that each point should not be be considered separately, and that VCs make their decisions based on all factors seamlessly integrated as a whole.

If you are aware of and pay attention to all the points mentioned above, it is highly likely that the fundraising process will be relatively smooth. For founders who are considering to start a business and raising for seed funding, I strongly recommend that you consult with reliable investors who can provide advice on the above matters.

I think it would be wonderful if we can fill in the information gap between entrepreneurs and investors, even if by a little, and for there to be even more startups that could change the world, even if by a few.